A new leading indicator by McGraw-Hill Construction points to a boost in spending.

|

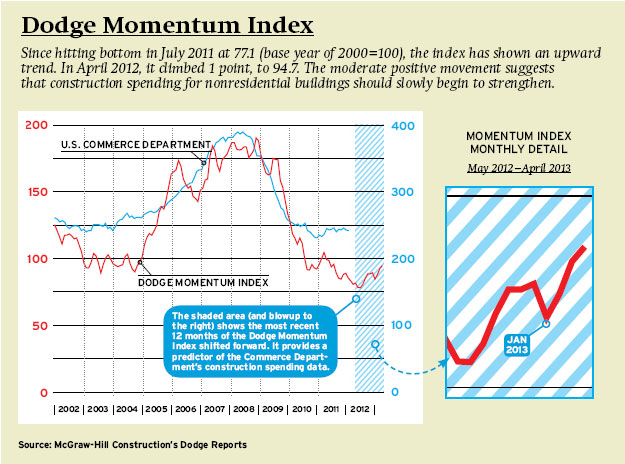

The Dodge Momentum Index is a new 12-month leading indicator of construction spending for nonresidential buildings. The unique information is derived from proprietary, first-issued planning reports in the largest database of construction planning projects in the United States–McGraw-Hill Construction’s Dodge Reports (McGraw-Hill publishes Architectural Record).

One-third of the projects in the Dodge database are in planning, and those projects feed the new Dodge Momentum Index. The strength of the new index is that it’s based on actual projects, many of which will become construction starts and generate construction spending. This approach differentiates the Dodge Momentum Index from other indices in the market. And, because the Dodge Reports gather such a large amount of information before projects break ground, the Momentum Index provides a reliable predictor for the U.S. Commerce Department’s nonresidential construction spending data.

The relationship between the two measures is extremely strong: An analysis conducted from January 2002 to February 2012 found a correlation of 0.91 with a 12-month lag (1.0 is perfect). This indicates that the relationship between the two measures is steadfast and that projects-in-planning will lead construction spending by a solid 12 months.

Recent trends in the Dodge Momentum Index suggest that better times are coming for nonresidential building. The index reached bottom in July 2011 at 77.1 (base year of 2000=100) and has gone up in all but two months since that time. In April 2012, the index climbed one (1) point from the previous month to a level of 94.7.

“The relatively steady upward trend since the middle of last year suggests that construction spending put in place for nonresidential buildings should begin to move in a more consistently positive direction during the second half of 2012,” says Robert Murray, vice president of economic affairs for McGraw-Hill Construction. “This is good news for an industry that has been strongly hit by declines since the 2009 recession.”

Both commercial and institutional construction have helped the index advance, although the institutional side of the market remains more tenuous, given constraints on public sector finances. From March to April 2012, the commercial components of the index rose 1.2 points, while the institutional components climbed just 0.8 points. In fact, new education-related planning projects entering the pipeline declined 0.5 points during April—a clear sign that publicly financed projects continue to feel the adverse impact of tight state and local budgets.

Despite financing difficulties, some education-related projects are still making their way to the drawing board. Noteworthy K–12 projects reported in April for the first time include an addition to a high school in Marion, Illinois, by Design Architects, Inc. Major higher-education projects include Perkins+Will’s conversion of a hospital building into a student activities and services center for the University of Massachusetts in Lowell.

Commercial projects, meanwhile, showed some strength in April, primarily due to an improvement in office activity. The office component of the Momentum Index shot up 7.2 points from March to April. Notable office projects that bolstered the planning pipeline include Foundry Square III, a speculative office building in San Francisco developed by Tishman Speyer and designed by STUDIOS Architecture; the new headquarters for Teva Neuroscience in Overland Park, Kansas, by Hoefer Wysocki Architects; and an office tower in Austin, Texas, designed by DudaPaine Architects.

Post a comment to this article

Report Abusive Comment